Introduction:

In the ever-evolving landscape of digital assets, services for tokenization has emerged as a transformative technology with the potential to revolutionize various industries. By representing real-world assets as digital tokens on a blockchain, tokenization opens up new opportunities for liquidity, fractional ownership, and enhanced transparency. In this blog post, we will delve into the concept of tokenization and explore the diverse range of services available for businesses and individuals looking to tokenize their assets. Join us as we unlock the power of tokenization and its transformative impact on the world of digital assets.

Understanding Tokenization:

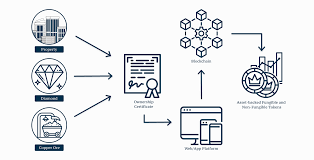

Tokenization involves the conversion of tangible or intangible assets into digital tokens that can be stored, transferred, and traded on a blockchain. These tokens can represent a wide array of assets, including real estate, artwork, commodities, intellectual property, and more. By leveraging blockchain technology, tokenization enables the fractional ownership and seamless transfer of assets, unlocking liquidity and expanding investment opportunities.

Benefits of Tokenization:

a) Enhanced Liquidity: Tokenization allows previously illiquid assets to be easily traded on digital asset exchanges, providing investors with access to a broader range of investment opportunities.

b) Fractional Ownership: Tokenization enables the division of assets into smaller units, allowing investors to own fractions of high-value assets, such as real estate or artwork, which were previously inaccessible to many.

c) Transparency and Security: Blockchain technology ensures transparency, immutability, and traceability of transactions, enhancing trust and reducing the risk of fraud.

d) Efficient Transactions: Tokenization eliminates intermediaries and streamlines the transfer of ownership, reducing costs and settlement times associated with traditional asset transactions.

Tokenization Services:

a) Tokenization Platforms: These platforms provide the infrastructure and tools to tokenize assets. They handle the technical aspects of creating and managing digital tokens, ensuring compliance with regulatory requirements and facilitating the issuance and distribution of tokens.

b) Asset Valuation and Due Diligence: Tokenization service providers often offer asset valuation services to determine the worth of the asset being tokenized. They may also conduct due diligence to ensure legal compliance and assess the asset's authenticity and ownership rights.

c) Legal and Regulatory Compliance: Tokenization service providers assist in navigating the legal and regulatory landscape associated with tokenization. They ensure compliance with securities laws, Anti-Money Laundering (AML) regulations, and Know Your Customer (KYC) requirements.

d) Smart Contract Development: Smart contracts play a crucial role in tokenization, as they govern the rules and conditions associated with the asset and its tokenized representation. Tokenization service providers can assist in developing robust and secure smart contracts tailored to specific asset classes.

e) Asset Tokenization and Management: These services involve the actual process of converting assets into digital tokens. Service providers guide asset owners through the tokenization process, including the creation, issuance, and distribution of tokens. They may also offer ongoing asset management services to ensure efficient operations and compliance.

Use Cases of Tokenization:

a) Real Estate: Tokenization enables fractional ownership of real estate, allowing investors to own a fraction of a property and gain exposure to the real estate market with smaller investments. It also simplifies property transactions, reduces barriers to entry, and enhances liquidity in the market.

b) Art and Collectibles: Tokenizing art and collectibles democratizes access to these assets. Fractional ownership allows art enthusiasts to own a share of valuable artworks, while artists can raise funds by tokenizing their work and selling fractional ownership to investors.

c) Intellectual Property: Tokenizing intellectual property rights, such as patents, copyrights, and trademarks, facilitates licensing, royalty distribution, and ownership transfers. It provides creators and inventors with new avenues for monetizing their creations and allows investors to participate in the potential future earnings of intellectual property assets.

d) Supply Chain Management: Tokenization can bring transparency and traceability to supply chains by representing individual products or components as tokens. This enables better tracking of goods, authentication of authenticity, and efficient management of inventory and logistics.

e) Investment Funds: Tokenization allows for the creation of digital investment funds, where investors can acquire tokens that represent shares in a diversified portfolio of assets. This opens up new possibilities for creating and managing investment vehicles with increased liquidity and accessibility.

Considerations for Tokenization:

a) Asset Eligibility: Not all assets are suitable for tokenization. Evaluating the characteristics and legal considerations of an asset is crucial before embarking on the tokenization process.

b) Regulatory Compliance: Tokenization may be subject to various regulations, depending on the jurisdiction and the nature of the asset. It is essential to work with legal and compliance experts to ensure adherence to relevant securities laws, AML regulations, and KYC requirements.

c) Technology Infrastructure: Tokenization relies on blockchain technology, so it's important to choose a reliable and scalable blockchain platform that suits the specific requirements of the asset and aligns with regulatory standards.

d) Investor Education and Market Adoption: Educating investors about the benefits and risks of tokenized assets is essential for widespread adoption. Tokenization service providers play a crucial role in facilitating market education and promoting the advantages of tokenized assets.

The Future of Tokenization:

Tokenization is still in its early stages, but its potential for disruption is immense. As blockchain technology continues to evolve, we can expect to see more diverse asset classes being tokenized, increased market liquidity, and improved regulatory frameworks that foster innovation and investor protection.

Conclusion:

Tokenization has ushered in a new era of possibilities in the digital asset landscape. By transforming real-world assets into digital tokens, tokenization offers enhanced liquidity, fractional ownership, and increased transparency. Through the assistance of tokenization service providers, businesses and individuals can unlock the benefits of tokenization, expanding their access to investment opportunities and revolutionizing traditional industries. As tokenization continues to evolve, it is crucial to stay informed, navigate regulatory landscapes, and embrace the transformative power of this technology. The world of tokenized assets is just beginning, and it holds immense potential for reshaping the way we own, trade, and invest in assets.

Sponsored

Unlocking New Possibilities: Exploring Tokenization Services for Digital Assets

Posted 2023-05-20 08:44:47

0

139

Search

Sponsored

Categories

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

Read More

EvrGlori Cream

EvrGlori Anti-Aging Cream - This great anti-ageing skincare item will make your skin look better...

Diaetolin Deutschland, Österreich & Schweiz (DE, AT, CH) Bewertungen & Angebotspreis

Die Diätpille Diaetolin Deutschland ist eine brillante Formel, die Ihren Weg zur...

Unveiling MPOMEGA: Understanding its Significance and Functionality

Introduction:

MPOMEGA is a term that has been gaining traction in various sectors,...

Reasonable Private company Website optimization Administrations

Suggest Article Remarks Print ArticleShare this article on FacebookShare this article on...

Feeling Confused About Choosing a Diamond or Moissanite Ring? Our Latest Blog Post Has Got You Covered!

Moissanite Ring: A Comprehensive Guide to Choosing the Perfect Ring Introduction: Are you feeling...

Sponsored